Benefits Of A Cash Management Solution

A robust cash management solution enables your organization to make sound decisions and avoid unexpected cash surpluses or shortages. Look for a solution that monitors cash inflows and outflows, and projects future cash positions using historical data. Also, ensure that the treasury management system you select can pipe in your bank’s real-time data. And evaluate whether the solution supports flexible finance dashboards/forecasts and reporting, and security controls.

Real-Time Visibility

A cash management solution that combines and automates data from various sources offers real-time visibility of cash positions across all financial accounts. This gives treasurers the opportunity to make informed financial decisions based on reliable information. It also allows businesses to forecast cash flows and cash requirements in advance and plan accordingly. It’s essential that treasury teams have global cash visibility to drive operational efficiencies and enable the business to leverage growth opportunities. However, there are several factors that can inhibit the ability to achieve full cash visibility.

Fortunately, there are many solutions that can help companies improve global cash visibility. These solutions can include a direct-to-bank API that automatically imports transaction data, consolidating it into a single source of truth. This enables treasuries to eliminate manual processes and improve reporting, analysis, and forecasting. It also helps to improve liquidity planning, reduce fraud and error, and enable better financial decision-making.

Analytics

The treasury management process is time-sensitive, and frequent cash performance monitoring is critical to prevent liquidity challenges. It also enables you to identify issues quickly, so you can solve them before they become more costly or potentially disruptive. Your vendors and banks are more receptive to problem resolutions when they’re notified early, and you can avoid last-minute cash shortages or surpluses by forecasting and projecting future needs. A cash management solution should have 21st Century data architecture, flexible finance dashboards/forecasts/reporting, and the ability to segment data by region, currency, division or even individual departments. More advanced solutions offer machine-learning or predictive analytics to improve forecasting accuracy.

Many companies that use a treasury management solution find they are able to eliminate manual data collection and analysis processes, improving forecasting quality, facilitating compliance with regulatory policies, and reducing the frequency of reporting errors that lead to cash flow restatements. Moreover, some solutions allow users to customize the formulas they use, making them more relevant for their specific business operations.

Reporting

Using a cash management solution enables teams to monitor and track their cash inflows and outflows. It also helps them make more informed decisions and save time by eliminating manual processes. Unlike spreadsheets, modern cash management solutions connect directly to banks via APIs to record and report on transaction data in real time. This allows for centralized reporting, eliminating the need for treasury teams to reconcile and manually aggregate data in multiple spreadsheets.

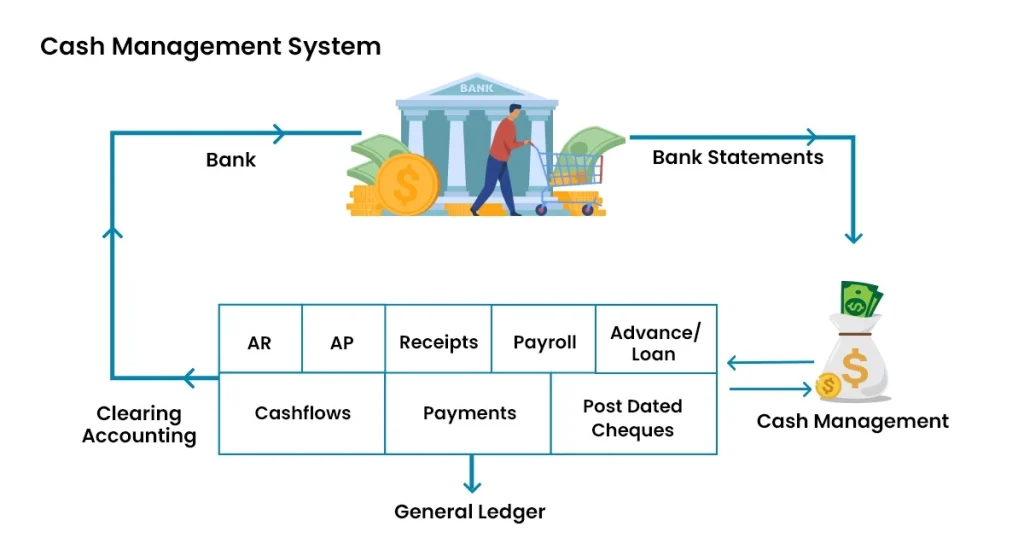

A cash management solution enables unified views of balances and positions, automates daily reconciliation of current and prior-day bank statements, and provides future cash balances and customizable cash position worksheets with real-time data ingestion. It can also automatically match data on cash transactions from daily, weekly and monthly bank statement to those recorded in the general ledger, with one-to-one or one-to-all matching options. For example, Tesorio is an “A/R Cash Flow Performance Platform” that replaces manual collection processes and synchronizes with ERP systems to prevent cash from slipping through the cracks. It also helps treasuries take the insights gained from the system and use them for forecasting, planning, and budgeting.

Integrations

Managing cash is an essential part of both people’s and companies’ financial stability. Companies can benefit from using a supply chain finance products to streamline their processes, improve accuracy, and reduce costs. Automating manual processes like bank reconciliations, cash positioning, and forecasting helps businesses optimize liquidity, avoid unforeseen financial challenges, and position themselves for long-term success. However, it can be challenging to find the right cash management software for your business needs.

The first step is identifying the specific goals you want to achieve with cash management automation. This will help you determine the resources and tools required to meet your objectives. Next, consider how the cash management solution will be integrated into your existing systems. The best solutions provide easy scalability and enable unified reporting of transaction data. They also support multi-bank connectivity and provide centralized administration of cash flows. Finally, they ensure compliance with data security standards.

Conclusion

Managing cash inflows and outflows is important for individuals as well as businesses. It’s about effectively meeting treasury goals and investing for growth. Get full visibility of cash movement and avoid exceeding lines of credit with automated forecasting that uses multiple Machine Learning techniques.